After signing up for a sandbox account and building out your payments experience, you can apply for a live account to begin moving funds.

A live environment enables your business to processes live transactions and real money movements.

Before you can get approved for a live account, Finix's underwriting team must collect and verify information that identifies you and your business as required by regulation and our financial partners.

If you signed up for a sandbox account, you can apply for live account by completing the form available in your sandbox under the Company tab.

Otherwise, reach out to your Finix point of contact they'll follow up with next steps.

Required Documents

Have the following documents ready to upload as you complete the live account form:

| Requirement | Description | Acceptable Documents |

|---|---|---|

| EIN Verification Document | A document from the IRS that verifies the submitted EIN. |

|

| Bank Document | A document from your bank that verifies the submitted bank details. |

|

Know Your Customer

Know Your Customer (KYC for short) is a due diligence process finance companies use to verify customers’ identities and assess customer risk.

KYC procedures help prevent money laundering, financial fraud, and other financial crimes.

Part of going live requires submitting certain identifying information, such as the name, date of birth and address of each applicable business owner, in order for Finix to comply with our KYC obligations.

Business Info

You must provide your Business Information. This includes information about the business, like the DBA name, Tax ID, EIN, and the date of incorporation.

You'll also be required to upload documentation that verifies the EIN of the business. Acceptable documents include:

- A Form SS-4

- A 147C Letter

Control Person

The application form collects information about key individuals in the business.

-

The control person is the individual who owns the business (sole proprietor) or is responsible for managing and controlling the business.

- If there are multiple substantial owners, add every Control Owner and pass 1% as the Ownership Percentage.

- You also need to provide the details of any beneficial owners. Beneficial owners own 25% or more of the business (up to 4 beneficial owners max).

Information the form collects includes:

- Full Legal names

- Title

- DOB

- Tax ID (SSN or ITIN)

- Phone Number

- Home Address

- Ownership Percentage

If further verification is required, Finix will request additional documentation that verifies the identity of the control person and/or beneficial owners. Acceptable documents may include:

- Passport

- State-issued ID card

- Driver’s License

- Bank Statement

- Utility Bill

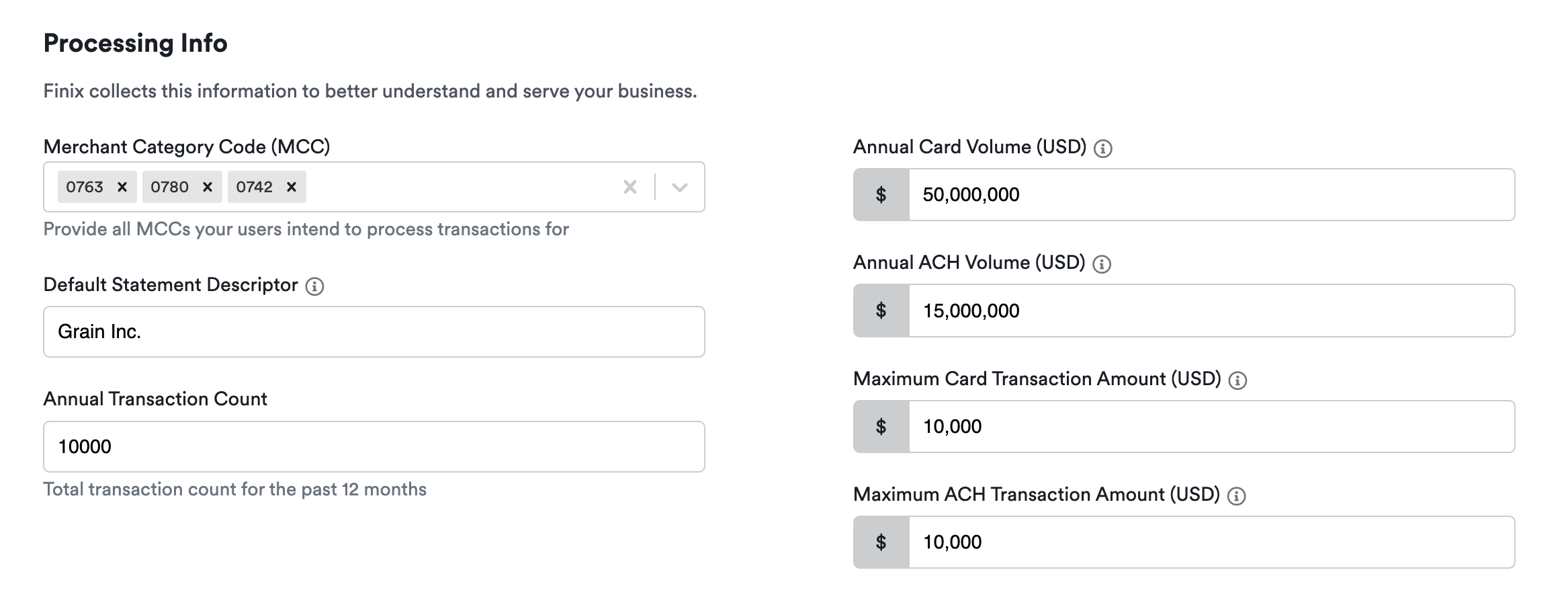

Processing Info

All businesses must also disclose their processing activity and the payment channels they've used for the past 12 months.

Information that’s collected includes:

| Field | Description |

|---|---|

| Annual Transaction Count | Total transaction count for the past 12 months. |

| Annual Card Volume | Approximate annual credit card sales expected to be processed by your company. |

| Annual ACH Volume | Average total amount of ACH transactions per year you expect to process. |

| Max Card Transaction Amount | The maximum amount per card transaction that your business allows to be charged. |

| Max ACH Transaction Amount | The maximum amount per ACH transaction that your business allows to be charged. |

Application Form - Processing Info

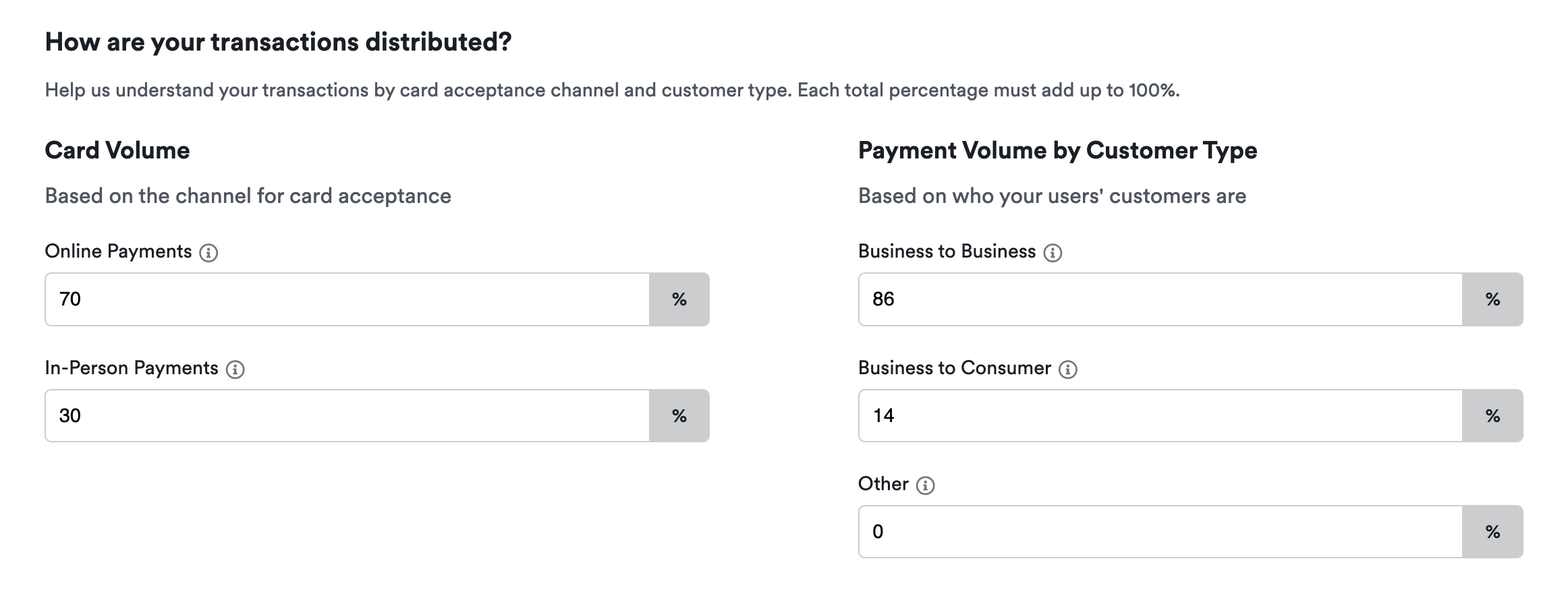

Transaction Distribution

The live account form also prompts you to detail the channels the entity used to process transactions (in terms of percentage; 0-100). Submitting this info helps Finix understand the transaction activity of businesses by card acceptance channel and customer type.

Information that needs to be submitted includes:

Card Volume

All businesses must also disclose their card volume for the past 12 months. The total entered for Online Payments, and In-Person Payments must total 100.

| Field | Description |

|---|---|

| Online Payments | The percentage of the volume you processed that was online only. This includes eCommerce, Apple Pay, Google Pay, ACH, etc. |

| In-Person Payments | The percentage of the volume you processed that was in-person only. This includes credit or debit cards, tap-to-pay, swipe, dip, etc. |

Payment Volume by Customer Type

All businesses must also disclose their payment volume for the past 12 months. The total entered for Business to Business, Business to Consumer, and Other must total 100.

| Field | Description |

|---|---|

| Business to Business | The percentage of the volume the entity processed that was between two businesses. |

| Business to Consumer | The percentage of the volume the entity processed that was between an individual person and a business entity. |

| Other | The percentage of the volume the entity processed that isn't captured by Business to Business and Business to Consumer. |

Application Form - Transaction Distribution

Bank Account

You'll be prompted to enter the information of the bank account where your business will receive payouts.

A document from your bank is required to verify the submitted information. Acceptable documents include:

- A notarized bank letter

- A bank statement that verifies the details entered belongs to the business owner.